does kansas have an estate or inheritance tax

Inheritances that fall below these exemption amounts arent subject to the tax. Many cities and counties impose their.

State Estate And Inheritance Taxes Itep

Some states have inheritance tax some have estate tax some have both some have none at all.

. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. Kansas Inheritance and Gift Tax. Kansas eliminated its state inheritance tax in 1998 and has not reinstated an.

Kansas has no inheritance tax either. Does kansas have inheritance tax. Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570.

Another states inheritance laws may apply however if you inherit money or assets from. States That Have Repealed Their Estate Taxes. What is capital gains tax on real estate in Kansas.

Delaware repealed its tax as of January 1 2018. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. States With No Estate Tax Or Inheritance Tax Plan Where You Die How Is Tax Liability Calculated Common Tax Questions Answered Holographic Wills In Wagoner County.

The state sales tax rate is 65. The top estate tax rate is 16 percent exemption threshold. Kansas Estate Tax.

Does kansas have an estate or inheritance tax. Seven states have repealed their estate taxes since 2010. Massachusetts and oregon have the lowest exemption levels at.

Does kansas have an estate or inheritance tax. This increases to 3 million in 2020 Mississippi. Property is cheap in Kansas with an average house price of 159400 so your.

No estate tax or. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. Exemption levels rise to 12 from 7.

Does kansas have an estate or inheritance tax. While each state sets its own laws regarding inheritance. No estate tax or inheritance tax.

Kansas is moderately tax-friendly toward retirees. Kansas does not levy an estate tax making it one of 38 states without an estate tax. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only.

The federal estate tax is calculated on the value of the taxable estate which is the amount that remains after subtracting the applicable 1118 million or 2236 million estate tax exemption from the total value of the estate. A federal estate tax is in effect as of 2020. The federal estate tax is calculated and paid.

Kansas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

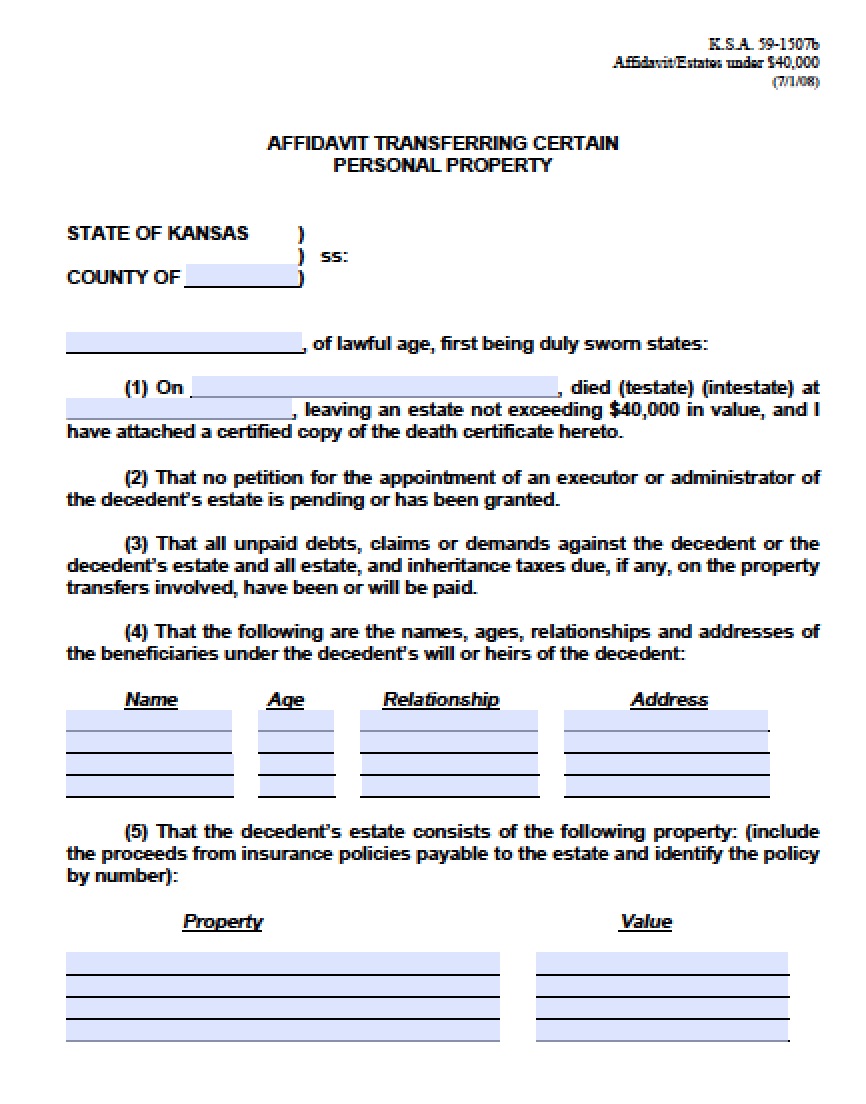

Free Kansas Small Estate Affidavit Form Pdf Word

Kansas And Missouri Estate Planning Inheritance Tax

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Does Kansas Charge An Inheritance Tax

Kansas Inheritance Laws What You Should Know

Kansas Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Estate Tax And Inheritance Tax In Kansas Estate Planning

Does Kansas Charge An Inheritance Tax

Kansas Inheritance Laws What You Should Know

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

Kansas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Retiring In These States Will Cost You More Money Vision Retirement

States With No Estate Tax Or Inheritance Tax Plan Where You Die